Women are certainly making their mark in the workforce, and the number of female chief executive officers is growing all the time. There are also many financial benefits available for women owned businesses. It appears that while there is still a discrepancy between talent and opportunity for women, things are improving all the time.

Bloomberg Businessweek posed the question in an article; did 2014 do anything for women at work? The conclusion was that while there has been progress in terms of women and men qualifying for the same jobs, women are still being paid less. The article also suggested that women are being hired by ‘diversity-loving’ companies but not necessarily for the most important jobs.

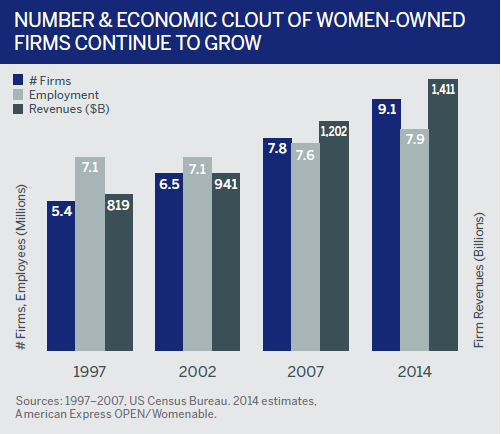

The American Express Small Business OPEN forum report on women owned businesses finds that ‘an estimated 1,200 new businesses a day were started by women over the past year, up from an average of 740 a day the year prior.’ Women now start Four out of 10 new firms. Women owned firms are also expanding across many different industries, and are even leading growth in industries such as real estate, finance/insurance and the wholesale trade.

Source: 2014 OPEN State of Women-Owned Business report

Source: 2014 OPEN State of Women-Owned Business report

This is all positive news, but the report does suggest that there is more to be done, and more support should be offered to women owned businesses to enable them to grow to the next level.

So what help is available? Specifically, the Small Business Association (SBA) has programs to help with funding, as well as a site dedicated to helping: The Office of Women’s Business Ownership, offering assistance in all areas of running a business and finding funding. Also offering access to federal contracting opportunities specifically for women owned businesses. Another great resource is the National Women’s Business Council, which advises on economic issues of importance to women business owners. While they may not cater specifically to women owned businesses, there are many small business financing options from the bank to alternative forms of funding such as invoice factoring. Since it is often necessary to have been in business for a period of time, and to have established collateral in order to qualify for more traditional forms of financing, accounts receivable financing may be an excellent option to optimize cash flow. This type of financing allows businesses to receive payment on invoices now that may not be due for payment for between 30 – 90 days. If your business has a healthy amount of outstanding invoices, this is certainly an option that is worth exploring.

There are most certainly benefits when it comes to women owned businesses, from specific grants, low-collateral loans, help with federal contracts, and certifications, to name but a few. Women are becoming a stronger force, and the number of women-owned businesses is predicted to grow significantly in the next five years according to Stephanie Burns; founder and CEO of Chic CEO. Stephanie provides a free resource for female entrepreneurs looking to start a business.