The good news is that qualification is not dependent upon the credit history of your business, rather the credit history of your customers, which means it is easier to qualify for invoice factoring than it is for a traditional bank loan.

Surprisingly invoice factoring can help you even if your company has:

Don’t let imperfect financial statements deter you from applying. Most factoring companies may work with you to find an answer and approve your application.

The qualification process requires basic company information, and can be completed in as little as 3 days, once the application is accepted. Once your company is qualified, make sure the work is completed on submitted invoices, and that the invoices are current.

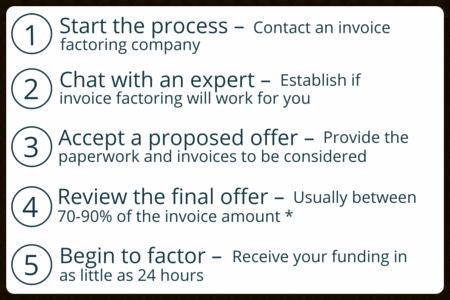

How it works – it’s easier than you think!

*The final offer is based on the amount of risk the invoice factoring company believes they may be taking by advancing the money. The amount of risk, creditworthiness of your customer, along with your volume of accounts receivable will determine the final rate.

Next » How much does it cost?

Copyright © Bay View Funding. All Rights Reserved.

All California loans made or arranged pursuant to a California Finance Lenders Law License 603 8709