Invoice factoring is an effective form of business financing.

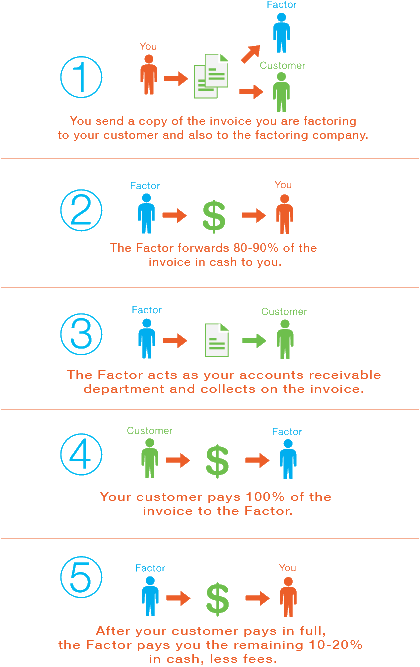

Rather than waiting 15, 30 or 60+ days for invoices to be paid, a factoring company will purchase your outstanding invoices and pay them in as little as 24 hours.

Cash now, for invoices due in the future means your company can use the cash to cover business expenses.

Let’s consider some cash flow challenges. Do any of these situations sound familiar?

Late payments can quickly cripple cash flow and bring a small or medium business to their knees. If these challenges sound familiar to you, invoice factoring could be the key to get your cash flowing.

Quick Qualification

Unlike a bank loan, the qualification process for invoice factoring only requires basic company information and can be completed in as little as 3 days, once the application is accepted.

Fast cash – no more waiting on slow paying clients

The factor will typically pay you within 24 hours after receiving your invoices. No more waiting for 15, 30 or 60+ days.

Use your own receivables as cash

Because you are using your own receivables, factoring will not show up on your balance sheet.

Imperfect Financial Statements – No Problem

Qualification for factoring is based on the creditworthiness of your customers, not your credit.

Accounts receivable managed by experts

The Factor’s professional A/R team manages the receivables that you factor, saving you time and A/R management expenses.

Reduce the stress of constrained cash flow

Factoring your invoices and getting immediate cash reduces the stress of late payment, the inability to pay taxes or meet payroll.

Waiting for customers to pay their invoices may be a large contributor to your company cash flow crunch. Invoice factoring offers fast payment of your invoices, which can help avoid this situation.

The process is fast and efficient: Our goal is to process your request to factor as quickly and simply as possible. For more questions, read our FAQ's.

Companies of all sizes, from small start up businesses to Fortune 500 corporations, choose factoring as a cash flow tool. Not only all sizes, but also many industries benefit from this type of alternative financing.

What some traditional lenders consider to be liabilities, we simply view as a client's way of doing business. That is why we finance:

Once your client is invoiced, a professional A/R team will manage the receivables you factor, saving you time and A/R management expenses.

If you are interested in learning more about invoice factoring and how it can help your business, see The Complete Guide to Invoice Factoring

call (888) 229-9993

*rates subject to change

Copyright © Bay View Funding. All Rights Reserved.

All California loans made or arranged pursuant to a California Finance Lenders Law License 603 8709