You are in the business of distribution, which makes you the master of time management! Not only that, you are more than likely able to juggle the many unpredictable elements that go into making your company a success.

What is involved, in simple terms?

-

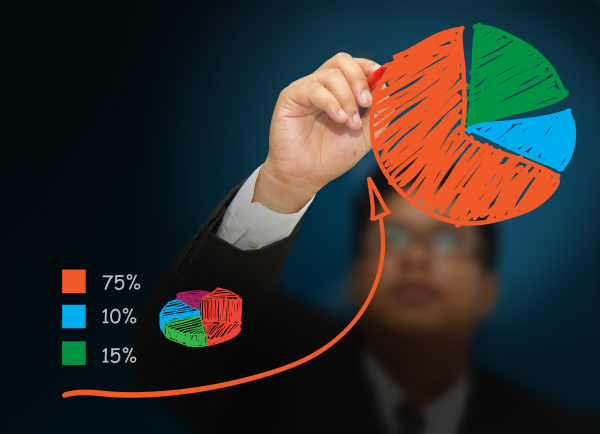

It’s all about consumer demand

-

Holding the right amount of inventory

-

Anticipating of the needs of your customers

Time must be carefully managed to make sure inventory arrives exactly when it is needed, in the correct amounts! But your customers are not necessarily so precise when it comes to paying their invoices, many government and commercial customers asking for 30 to 60 days to make payment on an invoice.